An analysis by Yulu Ao five hours ago suggests that the Chinese stock market is transitioning toward an earnings-driven growth model after a period where valuations may have appeared stretched. This shift is underpinned by improving corporate profits and supportive government policies aimed at long-term, high-quality economic development.

📈 The Transition from Valuation to Earnings

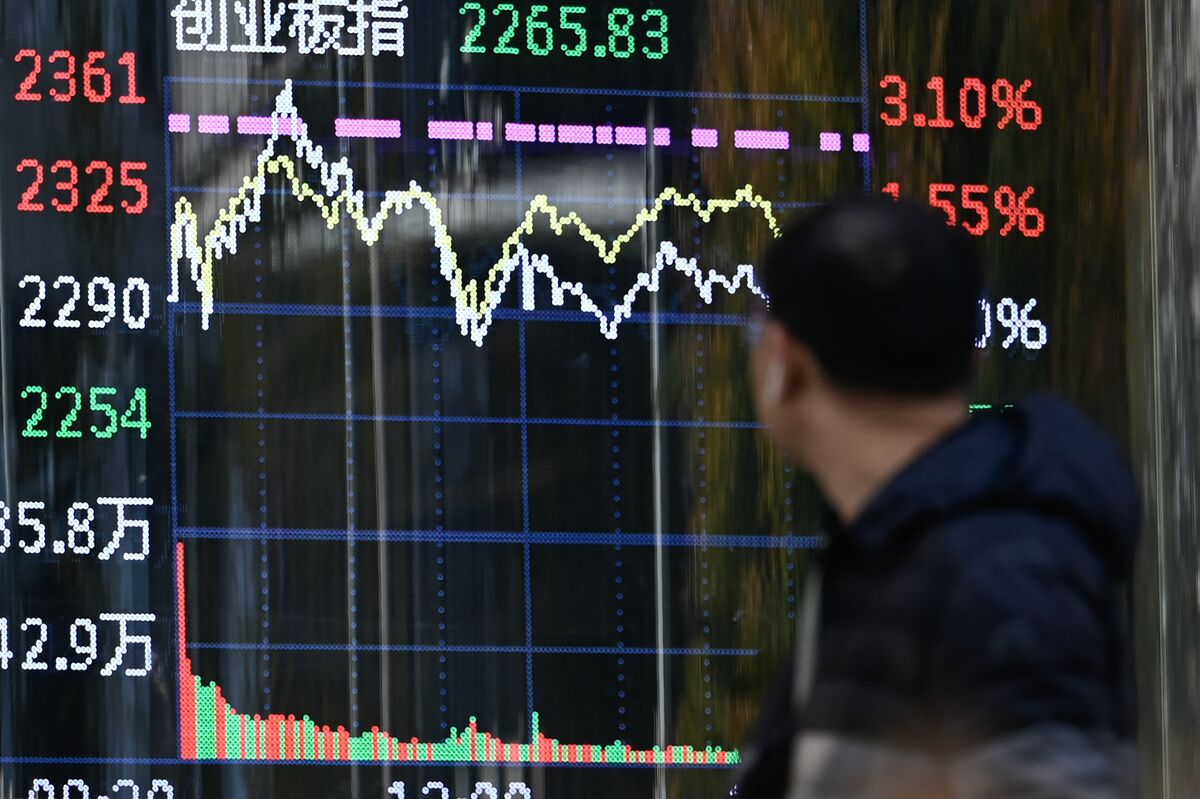

For some time, China’s stock market has experienced volatility, sometimes driven by speculative rallies or policy hopes that pushed up valuations (like the Price-to-Earnings, or P/E, ratio). However, recent market performance and analyst forecasts indicate that the next phase of growth is expected to be more fundamentally sound, based on the actual profitability and revenue expansion of listed companies.

- Attractive Valuations: Despite recent gains, the overall Chinese stock market, including the Shanghai Composite and Hong Kong’s Hang Seng, continues to trade at relatively low P/E multiples compared to global peers like the S&P 500. For instance, some reports indicate China’s P/E ratios are around 12x, which fund managers view as attractive.

- Improving Corporate Earnings: Strong third-quarter earnings reports, particularly from AI-related and “new economy” sectors like Information Technology, are contributing to investor confidence. Leading Chinese tech firms, for example, have seen aggregate profit double since 2021, even as their total market capitalization experienced a temporary dip.

🎯 Policy and Macroeconomic Support

The positive outlook is reinforced by the Chinese government’s comprehensive economic strategy, which prioritizes sustained, high-quality growth over short-term stimulus.

- Five-Year Plan Focus: The nation’s next Five-Year Plan (starting 2026) strongly emphasizes national self-reliance in science and technology, focusing on breakthroughs in cutting-edge industries like integrated circuits, AI, and biomedicine. This strategic focus is expected to provide a tailwind for companies in these sectors.

- GDP and Export Strength: Major financial institutions like Goldman Sachs have recently upgraded China’s GDP growth forecasts for the coming years, citing surprisingly strong export performance and the government’s commitment to advancing manufacturing competitiveness. The OECD also upgraded its 2025 GDP forecast for China to 5.0%.

- Targeted Stimulus: While broad stimulus has been limited, targeted policy support, including monetary easing and measures to boost domestic demand (such as the trade-in program for cars and appliances), are expected to support enterprise revenue and profit margin recovery.

💡 Sectoral Opportunities

Investors are now looking for structural opportunities in booming sectors rather than broad-market plays.

- Technology and AI: The AI boom and digitalization are driving growth for cloud service providers, gaming, and semiconductor companies. Valuations in China’s tech sector are seen as compelling, with robust earnings momentum enduring despite occasional post-earnings volatility.

- Global Leaders and Export-Driven Firms: Companies increasing their overseas revenue are gaining attention, supported by the competitiveness of Chinese products in the global supply chain, particularly in sectors like automotive, retail, and capital goods.

- Cyclical and Industrial Stocks: Fund managers are also favoring industrial and cyclical sectors, attracted by their lower valuations and policies designed to address overcapacity and price wars.

The consensus is that the protracted bear market phase is ending, and while volatility may persist, a long-term, more sustainable bull market driven by fundamental earnings growth is unfolding.